EXECUTIVE BENEFITS

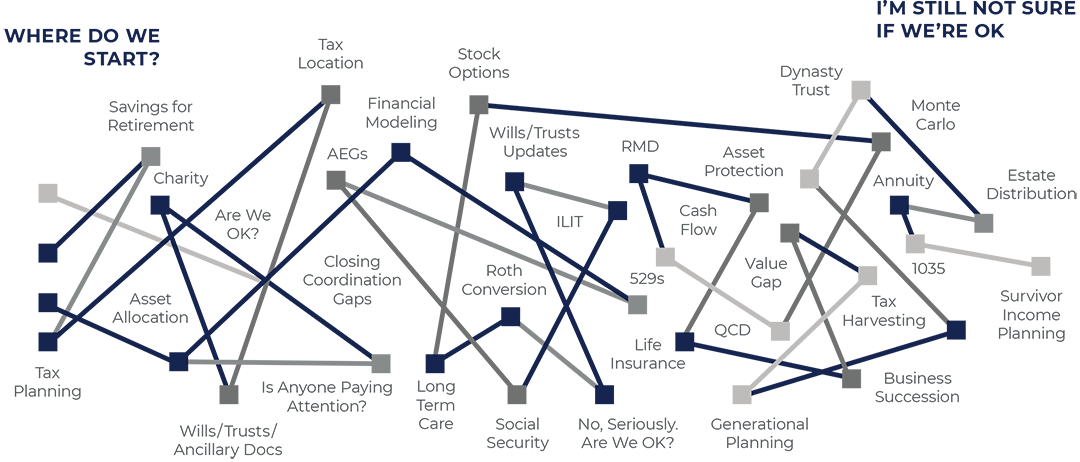

When and how should I exercise my options and awards?

Are there benefits I should be utilizing that I am not?

Can someone produce a cash flow model of my benefits and keep it current?

“It’s a great package. I just don’t understand it all or have time to review it.”

TAX REDUCTION STRATEGIES

Should I be contributing to a traditional or Roth 401(k)?

How much of my income should I contribute to deferred compensation, and what payout options make the most sense?

How else can I reduce my taxes now and in the future?

RETIREMENT ACCUMULATION & DISTRIBUTION

How do I create sustainable income in retirement?

Can I continue my lifestyle in retirement?

Why does sequence of returns matter?

What are the major risks that will affect my retirement?

INVESTMENT PLANNING

Am I on the right track?

Am I getting strong returns for the level of risk I’m taking in my portfolio?

What is my probability of success relative to my goals?

How do I protect against downside risk?

ESTATE PLANNING & ASSET PROTECTION

Are we OK?

Is my family OK?

Is my community OK?

Will my assets flow properly to my loved ones?

How do I quantify my family’s exposure if assets are left unprotected?

INSURANCE AUDIT

Are my earning power and family properly protected?

Do I have the right coverage, in the right amounts, and structured properly?

Am I overpaying for my insurance?

How much can I really afford to self-insure?

Is insurance a “set it and forget it” asset class?

800 Westchester Avenue

Suite N-335

Rye Brook, NY 10573

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

© 2026 Hightower Advisors. All Rights Reserved.

![HT-SillerCohen Logo[W]](https://images.ctfassets.net/nac4rsvtoh64/6YXyNmyAw4NIxZGMMxhbSA/d1a2dd9959ac195f4676eb963afd14c2/HT-SillerCohen_Logo-W-.svg)