Every situation is unique, but in our experience estate planning typically starts with three fundamental questions…

ARE WE OK?

IS OUR FAMILY OK?

IS OUR COMMUNITY OK?

Where do you begin?

A truly effective estate plan should consider consequences, both during your life and after your death. It requires a combination of careful thought, professional guidance, and detailed financial modeling/scenario analysis to answer the following:

WHO WOULD YOU LIKE TO BEQUEST ASSETS TO?

IN WHAT AMOUNTS?

CAN YOU BEGIN GIVING WHILE YOU ARE ALIVE WITHOUT IMPACTING YOUR LIFESTYLE?

WHO DO YOU WANT TO BE THE LARGEST BENEFICIARY OF YOUR ESTATE?

Key areas to consider

ASSET PROTECTION

Well designed and drafted documents can protect your assets now from:

- CREDITORS & PREDATORS

- DIVORCING SPOUSES

- LIABILITY LAWSUITS

- BANKRUPTCY

The right design can also protect future generations from the same threat of unintended beneficiaries of your estate.

TAX SAVINGS

Does your plan take full advantage of all the available tax exemptions and credits so that less of your wealth is lost to estates taxes, and more is passed to your loved ones?

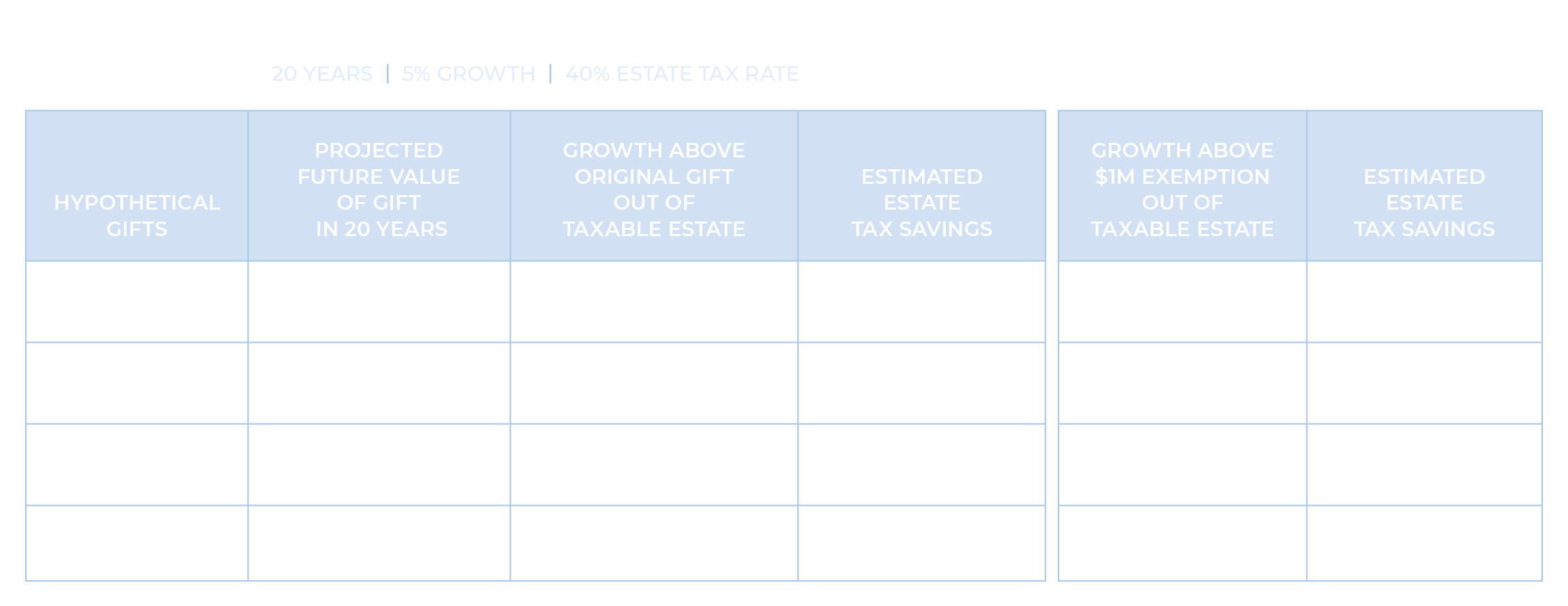

Have you considered accelerating a portion of your wealth transfer now vs. when you pass in an effort to reduce taxes and maximize the amount of money to your desired beneficiaries without impacting your lifestyle?

FLEXIBILITY

Loss of access to gifted assets is often a reason gifts aren’t made in the first place. What if you can make an irrevocable transaction?

With regard to your legal documents, careful design can ensure that as much flexibility as possible is retained. This will allow you and/or your children to address and adjust to unforeseen circumstances.

FIDUCIARIES

Do you have the right fiduciaries in place (executors, trustees, guardians for your kids)?

Have you put your fiduciaries in the best position to succeed?

Do they know:

- What your wishes are?

- How to locate your legal documents and assets?

- How to handle your digital footprint (email, banking, social media, subscriptions, etc.)?

It’s great that you’ve maximized your planning during your lifetime and that you’ve set up an efficient will/revocable living trust to handle your estate at your passing, but it doesn’t end there.

What steps can you take now to reduce the administrative stress for your loved ones after your passing?

Have you communicated your intentions to your loved ones?

How we may be able to help

We can potentially reduce your estate tax exposure substantially. We focus on designing sophisticated multi-generation trust strategies that move significant amounts of family wealth “over the tax fence” where it will no longer be subject to estate tax and can instead be passed down to benefit future generations. At the heart of this planning is financial modeling/scenario analysis to determine how much giving can be achieved during your lifetime without impacting your lifestyle.

- A careful review of appropriate estate planning designs and strategies, including SLATs, GRATs, sales IDITs, charitable and other strategies

- Financial modeling to determine which estate planning techniques you can afford to implement without impacting your lifestyle

- A detailed summary of the final estate plan, with diagrams that illustrate complex designs in an easy-to-understand format

- Coordination with your attorney to review your final legal documents to confirm they reflect the desired design

- Monitoring of the implementation of all aspects of your estate plan

- Ongoing monitoring of your estate plan to confirm that the plan is moving toward achieving your evolving goals and objectives

Chrysler Building

405 Lexington Avenue

42nd Floor

New York, NY 10174

914.269.2470

800 Westchester Avenue

Suite N-335

Rye Brook, NY 10573

Legal & Privacy

Web Accessibility Policy

Form Client Relationship Summary ("Form CRS") is a brief summary of the brokerage and advisor services we offer.

HTA Client Relationship Summary

HTS Client Relationship Summary

Securities offered through Hightower Securities, LLC, Member FINRA/SIPC, Hightower Advisors, LLC is a SEC registered investment adviser. brokercheck.finra.org

© 2024 Hightower Advisors. All Rights Reserved.

![HT-SillerCohen Logo[W]](https://images.ctfassets.net/nac4rsvtoh64/6YXyNmyAw4NIxZGMMxhbSA/d1a2dd9959ac195f4676eb963afd14c2/HT-SillerCohen_Logo-W-.svg)